|

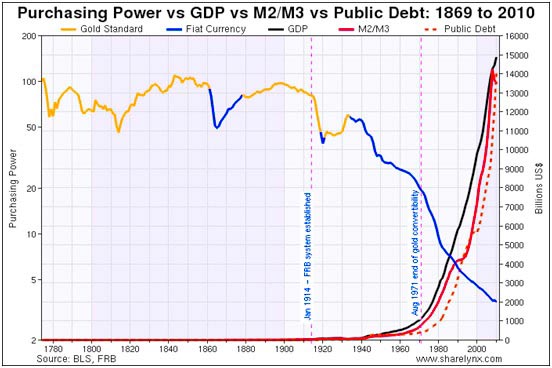

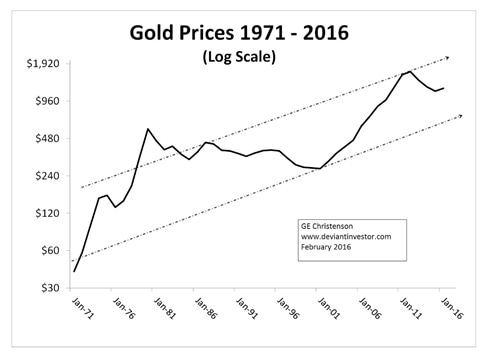

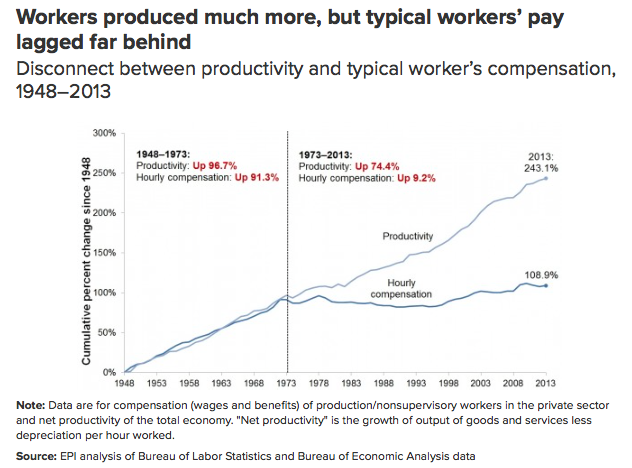

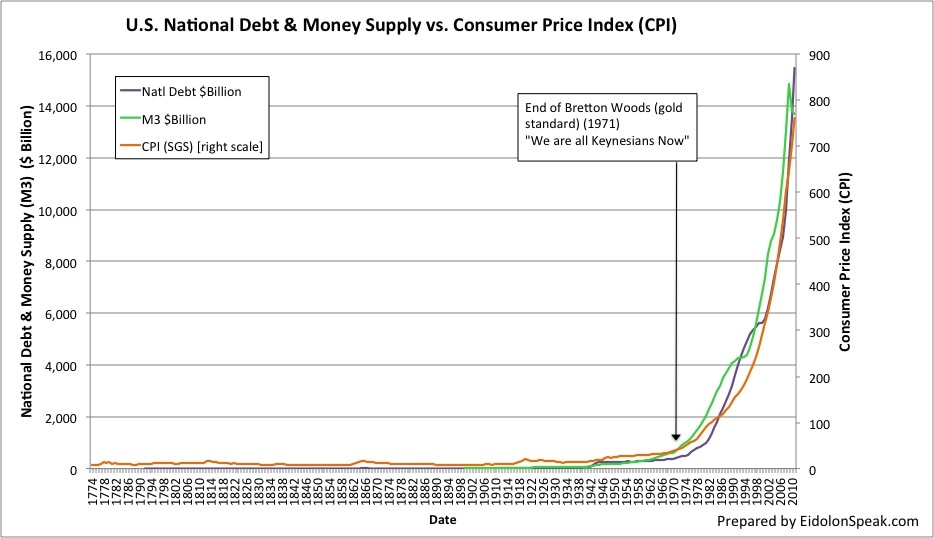

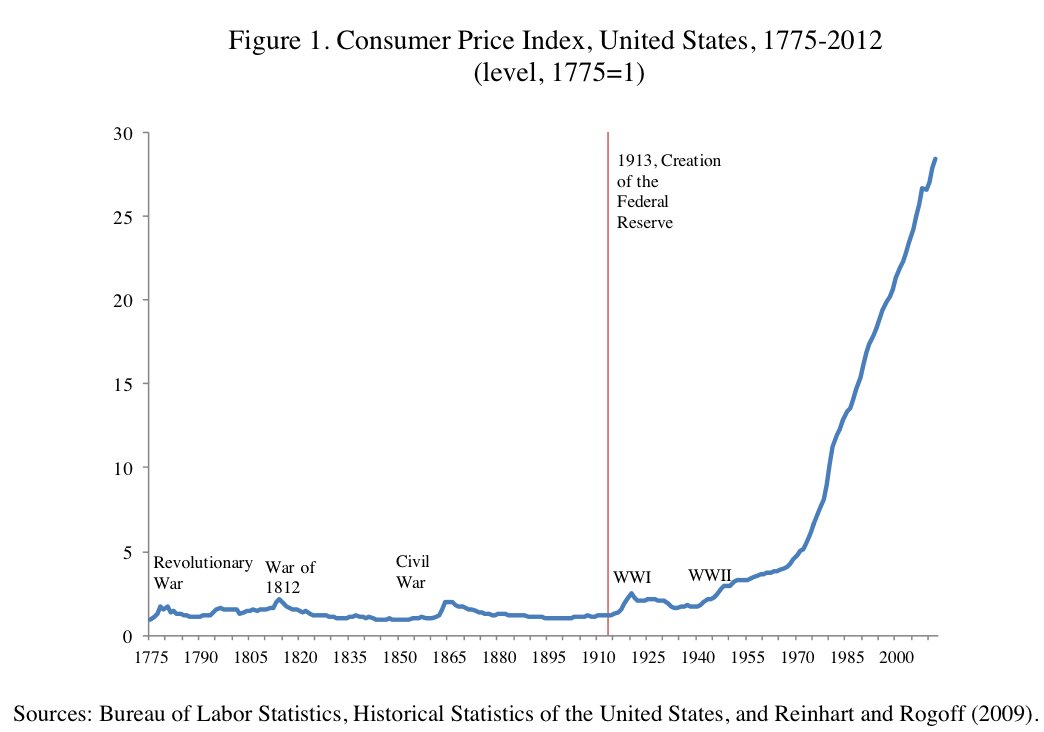

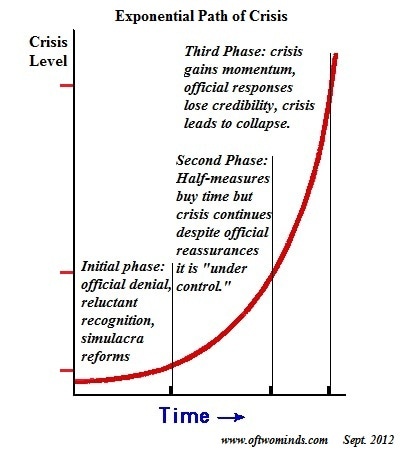

The early 1970's was a whirlwind era that would forever change both America and the world. In 1971, Intel released the world's first microprocessor - the foundation of today's computers. China was admitted to the UN (United Nations). The Nasdaq, a now-popular stock market index, debuted. The environmentalist group Greenpeace formally came into existence as an organization. NPR (National Public Radio) broadcast for the first time. Ever gone to the hospital to get a CAT scan? Yep, that was first produced in 1971. Ever used a Texas Instruments calculator? Yep, that too was first released in 1971. Do you wear contact lenses? Those first became commercially available in the U.S. in 1971. You know that body armor soldiers wear on the battlefield? Yeah, Kevlar. That went on the market in 1971. Have you ever used FedEx to send a package? It was started in 1971. Have you ever been to Disney World? It first opened in 1971. A lot happened in '71. The real story though is that President Richard Nixon took the United States off the gold standard. This article is an exploration of what trends have been enabled by it and what has taken place because of it. "As to the assumed authority of any assembly in making paper money, or paper of any kind, a legal tender, or in other language, a compulsive payment, it is a most presumptuous attempt at arbitrary power. There can be no such power in a republican government: the people have no freedom — and property no security — where this practice can be acted: and the committee who shall bring in a report for this purpose, or the member who moves for it, and he who seconds it merits impeachment, and sooner or later may expect it." - Thomas Paine, 1786, in his "Dissertations on government, the affairs of the bank, and paper money." See a more full quote here, as well as a link to the original: [Link] To be more specifically correct, the U.S. went off the gold standard in 1933. FDR did this after listening to one man - the rest of his advisors were adamantly against it (the assistant secretary of the Treasury resigned in protest). On the other hand, today it is credited by the vast majority of economists as being the reason why the U.S. got out of the Great Depression relatively quickly. The "gold standard" simply meant that our currency (denominated in dollars) was backed by gold. In order to combat the Great Depression, the U.S. decided to take the plunge; because, according to Keynesian economic theory, one of the best ways to fight off an economic downturn is to inflate the money supply. At the time, our currency was backed by gold at exactly $20.67 per ounce. Afterwards, gold was banned. Everyone had to turn in their gold to the government (to the Federal Reserve, actually). Congress changed the laws that required debtors to repay creditors in gold dollars of the same weight and fineness as those borrowed. Then, the government declared that the price of gold was increased to $35 per ounce. Magically. Overnight. This had the effect of increasing the gold on the Federal Reserve’s balance sheets by 69 percent, and this increase in assets allowed the Federal Reserve to further inflate the money supply. Crazy, right? It gets crazier. From 1933 until 1971, the government held the $35 per ounce price. Then, President Richard Nixon announced that the United States would no longer convert dollars to gold at a fixed value, thus completely abandoning the gold standard. It took three more years (in 1974) for President Gerald Ford to sign legislation that permitted Americans to again own gold bullion. For 40 years the American people weren't allowed to buy or own gold. Mind-blowing, isn't it? So in 1971 the U.S. - and in effect the world since the dollar was/is the world's reserve currency - economically steered towards a whole new horizon. Going completely off the gold standard enabled the Federal Reserve to steer the economy in new ways. Not tied to gold, they could adjust the amount of money in the economy at will. They were suddenly able not only to adjust interest rates across the board, but also literally inject "monetary liquidity" into the market at any time. This is what is meant by the phrase "printing money out of thin air." They aren't actually putting more physical paper into circulation, they are just adding zeros on a computer - but the effect is the same. National debt? That's fine, the Federal Reserve will just add some more zeros onto the tab and make "money" magically appear. This is why the debt ceiling debate in Congress always ends up with legislation "raising" the debt ceiling. Because, who the hell cares when it's all fake anyway? The rest is partisan bickering over pet projects getting funded. So what happened since then? Why is this such a big deal? Personally, I'm a very visually-oriented person and I really like representational data. So, here are a few graphs: Notice what year this graph starts going exponential: Conclusion:

2 Comments

Dennis Mitchell

6/1/2017 07:41:40 am

It was still common to get silver coins in your change. Real silver!

Reply

Mark Richardson

11/1/2019 10:27:42 am

In the 1976-77 school year the cost of resident undergrad tuition at Western Michigan University was $30/credit-hour and minimum wage was $2.30/hour. The cost to live in the dorm with all you could eat food service was $490/semester.

Reply

Leave a Reply. |

The future is going to be far different than the past. The next decade is going to look vastly different than the last decade. This blog is about the transition.

If you like what you see, contribute to making this blog a success here:

Recent Posts: Physical Preps and Tools Prepping Priorities - Physical & Psychological 2022 US Threat Assessment Part II 2022 US Threat Assessment Part I GONE Bag: Get Out Now Emergency Tactical Gear Considerations Interview with Derrick Jensen 2020: A Marker For Collapse Firearms And Our Future Thermodynamic Failure: Phase 2 Firearms and Defense Syria 1971 Explaining Peak Oil Graduate-Level Preparedness The Significance of Renewables Preparing What Will The Future Look Like? What Do The Experts Say? Hope is Complex and Fragile Historical Perspective Personal Change Does Not Equal Social Change Why Genesis 1:28 Doesn't Apply It's Not About Running Out of Oil Introduction |

RSS Feed

RSS Feed