|

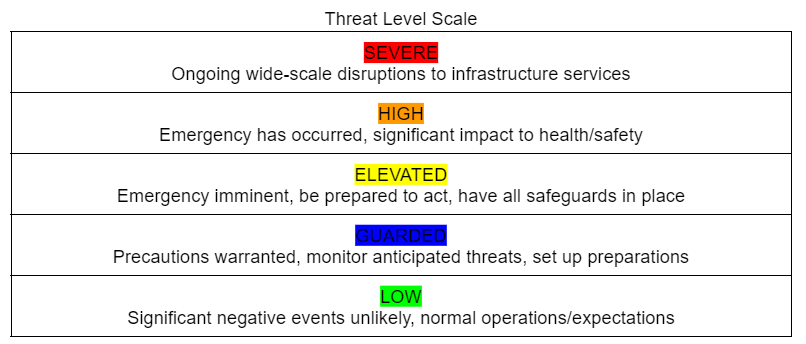

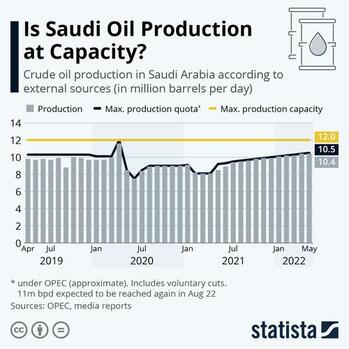

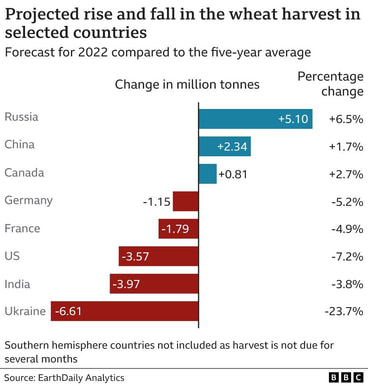

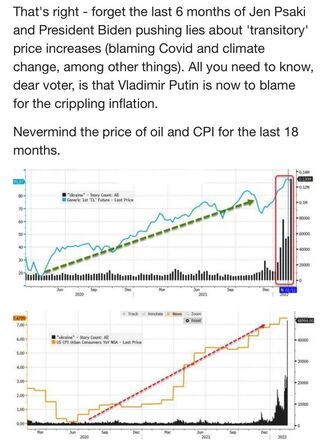

Summer 2022. Threat level increase from LOW to GUARDED. “To put it simply, we are facing a crisis on top of a crisis.” - Kristalina Georgieva, IMF Managing Director, Washington DC, 2022 The International Monetary Fund has cut its global growth estimates for 2022 and 2023 and has downgraded its growth outlooks for 143 economies representing 86% of global economic output. Managing Director Georgieva gave a speech to the Carnegie Endowment for International Peace in Washington this past April, giving the dire warning that “the world is in a very dangerous time.” The IMF assessment is that the global order has been severely impacted, and warns of a major new threat: the “complete fragmentation of the global economy into geopolitical blocs, with differing trade and technology standards, payment systems, and reserve currencies”. This “will send shockwaves throughout the globe.” She also stressed that these multiple crisis points are aggravating food insecurity across the globe, with disruptions to grain and fertilizer supplies that are driving up food prices: “Without urgent, coordinated action to bolster food supplies, many countries face more hunger, poverty and social unrest.” She went on to say that “since January, the outlook has deteriorated substantially, largely because of the war [between Russia and Ukraine] and its repercussions”, including “bottlenecks in global supply chains”. Georgieva warned that fragmentation of the global economy is the biggest threat since World War II, saying that “such a tectonic shift would incur painful adjustment costs,” that “supply chains and production networks would be broken and need to be rebuilt,” and that there will be massive “dislocations." Introduction and background: Here’s the short version of why things are the way they are, at their fundamental roots. Everything is a measure of energy - specifically, extra (or “net”) energy. Total world oil production peaked in November of 2018. The US accounted for 98% of global oil production growth in 2018 due to the “shale boom”. These unconventional oil sources - fueled by ridiculous debt, artificially held low interest rates, trillions of dollars of “Quantitative Easing”, etc - pushed the peak further into the future even though conventional oil peaked worldwide in 2005. This largely discredited the whole idea of “peak oil”, and the term, for the mainstream. The only reason total production did not peak beforehand was because of shale, which notably does not give anywhere near the same net energy we've come to rely on for the complexity of civilization. The cheap, easy to extract, high yield conventional oil peaked worldwide in 2005 (2006 according to IEA data). What we were left with was unprofitable and gave paltry net energy comparatively. This is what some have called a "civilization shrinker." We saw this playing out across the world as stymied economic growth, a gutting of the middle class, and lower living standards - as well as skyrocketing debt, little to no savings, and inability to financially handle unexpected bills. Peak oil's restraints have been here for a while. They come from these byproducts of having used up the majority of the low-hanging fruit - the easily extracted high yield oil. And now we are past total production peak, and have had two major global issues that have combined to create a lot of trouble for trade and economies: the Covid pandemic and the Russia/Ukraine war - which is why things will continue to spiral rather than get better. The geopolitical shenanigans we see playing out today are based on these consequences, seen through the lens of energy, services, commodities, and food. It’s not going to get better, no matter who people want to blame, or elect. Expect a lot of volatility followed by scarcity. Things are going to get a lot more local. A lot of people rely on these systems and services, and there will be a lot of dissonance and anger as they come crashing down like dominoes. Inflation, Interest Rates, and Debt: The problems have gone mainstream. Major news outlets are inundated with the news that inflation is at a 40-year high. Prices for some goods and services have jumped to the largest one-month increase on records dating to 1967. Warnings of a 70’s-style energy price shock and shortages situation in the near future have been made repeatedly, outdone by other mainstream media outlets projecting that the next financial crash will be “worse than the Great Depression.” US household debt now exceeds the peak in the 2008 Global Financial Crisis at $13.3 trillion. Outstanding student loans were $611 billion in 2008 during the GFC, now they are over $1.5 trillion. Auto loans, at nearly $1.25 trillion, have exceeded the 2008 total, while credit card balances are just as high now as before the Great Recession. Global debt is now $247 trillion, up from $177 trillion in 2008 - close to 2½ times the size of the global economy. The Federal Reserve has made fighting inflation its number one priority this year, and has reversed their artificially-held low interest rates policy which they have had in place for decades; they are now raising interest rates, aggressively, to combat inflation. The problem is that these previously mentioned debts must eventually be repaid, and the tipping point will come when a wave of defaults by overwhelmed borrowers - squeezed by rising interest rates - leads to a widespread reduction in spending and incomes. There is an inevitable reckoning ahead in the stock markets. Energy Crisis: At a global energy forum in Sydney, Australia, a few weeks ago (July 12, 2022), the head of the International Energy Agency (IEA) Fatih Birol said: "The world has never witnessed such a major energy crisis in terms of its depth and its complexity. The unprecedented global energy crisis threatening the world economy is likely to get worse in the coming months." Market Insider has reported extensively on this: “Soaring energy prices have rattled economies around the globe after Russia's invasion of Ukraine triggered a string of Western sanctions on the country's oil and gas supplies, ultimately leading to severe supply constraints. In the US, the rising cost of energy has contributed towards high levels of inflation stinging all corners of the economy and specifically hurting Americans at the pump. Russia meanwhile, has been raking in bumper profits from its oil and gas sales to Asia, as countries like India and China double down on cheap Russian energy. To that effect, Russia stands to earn $285 billion this year from its oil and gas sales. With the European winter just a few months away, Birol said the region will face great challenges as Russia rattled energy markets even further.” While gas prices at the pump have noticeably decreased recently, oil on the world market remains over $100/barrel, with projections by big banks such as JP Morgan saying it could rise stratospherically to over 3 times that number. In response to high gas prices and high inflation, the Biden administration has been releasing more and more oil from the US Strategic Oil Reserves. (We currently have only about 480 million barrels of oil left, which at a US daily consumption rate of 20.6 million barrels, means we have about a 23-day supply. But this is crude oil - it must be refined and then distributed, which takes months. Meanwhile, the government continues to sell it off.) Biden himself paid a highly-publicized visit earlier this month (July, 2022) to the Middle East in order to plead for increased production to ease supply problems. Saudi Arabia and the United Arab Emirates are the only OPEC members who have spare production capacity – at least on paper. But Biden’s visit revealed a hard truth - there is much less space capacity than believed by many western leaders. Saudi Arabia has said for years now that its maximum production capacity is 12 million barrels per day. They have only hit that figure once (in April of 2020) since 2019, even before the Covid pandemic. They were at about 11 million in August of 2022. In Biden’s visit pleading for an increase in production last week, the ruler of Saudi Arabia, Crown Prince Mohammed bin Salman, said: “The kingdom has announced an increase in its energy capacity to 13 million barrels a day. After that the kingdom will have no further capacity to increase production.” This announcement has had a revelatory effect: we can no longer rely on the Middle East to supply the world’s oil. They say that they will slightly increase production capacity, but there is significant doubt that they can do even this - and capacity is not the same as production. Food and Climate Change Impacts: Despite protestations that price increases are all the fault of the double-whammy of the Covid pandemic and the Russia/Ukraine conflict, prices were rising for systemic reasons even before then. In March of 2019, 38% of all US soybean, corn, and wheat went off the market due to catastrophic flooding in the Midwest. In May of 2021, China bought an astounding 37% of corn exports from the US. In fact, China bought and imported 28.35 million tonnes of corn from around the world in 2021 - before the invasion of Ukraine. In 2021 they also harvested nearly 5% more corn and 2% more wheat in their own country, in a push to increase storage amounts. Then the invasion of Ukraine began, and commodity prices soared. Russia and Ukraine accounted for about 31% of world wheat trade, 30% of world barley trade, and around 29% of 'sunoil' trade. The Russia-Ukraine crisis created a realignment of world trade, resulting in bottlenecks and price volatility. Sadly, many people in the West have forgotten the importance of commodities, industry, and energy in terms of geopolitical leverage. There’s a food crisis coming this winter, along with a host of other predicaments. In the Western US, an unrelenting megadrought has been worsening, causing lakes and reservoirs to dry up and wildfires to spread in an unprecedented way. In fact, a new peer-reviewed study titled "Rapid intensification of the emerging southwestern North American megadrought in 2020–2021" says the last 22-year dry period is the worst since the Vikings and Mayans ruled parts of the world, or about 1,200 years ago. The study’s lead author, Park Williams, a climate scientist at the University of California, said: “Anyone who has been paying attention knows that the west has been dry for most of the last couple decades… Rather than starting to die away after wet years in 2017 and 2019, the 2000s drought ramped up with authority in 2020-2021, making clear that it's now as strong as it ever was.” Water levels in Utah's Great Salt Lake and Lake Powell have dropped to their lowest levels ever recorded. This summer's extreme drought and compounding heat waves have triggered a water crisis in the Western half of the U.S. The lake is a crucial holding tank for outflow from the Colorado River Upper Basin States: Colorado, New Mexico, Utah, and Wyoming. Lake Powell alone (the second-largest reservoir in the U.S) supplies water to up to 30 million people and irrigation of 5 million acres. Just a week or two ago (July15th, 2022), mainstream media (Bloomberg) reported that “California’s historic drought may leave the state with the largest amount of empty farmland in recent memory as farmers face unprecedented cuts to crucial water supplies… Fallow farmland could reach roughly 800,000 acres.” They remind us that California accounts for 25% of all US food production. Heat Waves: All over the world this year, record-breaking heat waves with long periods of temperatures well over 100 degrees fahrenheit have been baking the population and causing unprecedented wildfires, water scarcity, grid failures, and deaths - not only in the US, but also large swaths of Europe and the Middle East. Especially in Europe, lifestyles and infrastructure are not adapted - less than 5% of the population in the UK have air conditioning. Solar panels are literally melting in the heat. In London, houses are combusting and catching on fire. Their largest military base shut down because their airport runways melted. In Britain, Italy, France, Portugal, Spain, Germany, and Belgium, thousands of fires are burning out of control. These fires have destroyed businesses, houses, schools and churches; they have caused significant travel delays and public transportation problems due to wires, tracks and signaling systems catching fire or melting. As The Guardian reports: “The climate disaster is here, with temperatures soaring across Europe, the US and much of the northern hemisphere – and scorching summers becoming the norm. As scientific predictions become reality, the emergency is becoming palpable, indisputable and widespread, with dramatic weather events reported with an ever-increasing frequency. Such patterns have disastrous, far-reaching effects –for the natural world, global food supplies, health, infrastructure and more.” And this is not exactly new, though it is now on the front pages of Western media it has been happening in Africa for a while now. In fact, the blistering heat now affecting Europe is part of a weather system that has moved up from North Africa. The World Health Organization said this month that over 33% of people in Africa are facing extreme water scarcity. The World Bank announced that in the coming years at least 86 million Africans will be forced to leave their homes and find someplace else to live. Africans are already suffering brutal impacts: rapidly intensifying hurricanes, devastating floods, and withering droughts. While north Africa has been intensely dry and hot leading to drought, south Africa has had severe flooding which destroyed crops and farmland, and east Africa was invaded by swarms of locusts that devoured crops - brought on by heavy rainfall and abnormally hot temperatures. Bottom line: The frequency, intensity and duration of heat waves is causing greater impacts, not just to infrastructure but also to food production around the world. Conclusion Analysis: My general thought is that clearly Russia and China know about ‘peak everything’ and Russia decided to make the first big move to consolidate power in a post-peak world by invading Ukraine. It’s a bold move, and it puts Russia as the global scapegoat for worsening consequences, but the long game here is that this is an assertive action to take control rather than be a victim of circumstances - even if that means being perceived as the bad guy on the world stage. They can do this because 1) they control some powerfully key things, such as natural gas to Europe, grain commodities like wheat, pipelines, and have robust cyber attack capabilities, and 2) they are forcing a global division between east and west - which really started way back with Syria - where Russia and China cooperate against the U.S. and Europe. It’s exceedingly interesting how the western media has immediately tried to change the narrative to blame Russia, even though all these trends started way before Russia invaded Ukraine. The average American or European will now look at Russia as the source of their economic woes and completely forget that any of these trends were happening before yesterday. It seems certain now that the invasion of Ukraine by Russian was the lynchpin, the cornerstone, the big domino, the black swan - and that sanctions were expected and taken into consideration in their effort to divide the world. I’m convinced that there is a group of people who are very aware of ‘peak everything’ and energy trends, who have the insider knowledge to have understood and planned for this. And I lean towards the theory that Putin and Xi are some of those people. The whole Russia and China and allies versus the US and EU and allies has been going on for at least two decades. China has bought up commodities like wheat and gold and gotten out of US treasuries for years. They’ve been preparing. Russia knew that their invasion of Ukraine would lead to crippling sanctions, they knew they would be the West’s scapegoat on the world stage, and yet they acted. The balance of global power has massively shifted, and it’s been coming for a long time. They picked the right moment, strategically. And they (Russia and China) hold almost all the cards. We offshored production manufacturing to China decades ago. They have the food, the gold, and control access for much of the world to all the things we need for a functioning global/national community. American imperialism is coming to an end, and so is industrial civilization. This is “it”. From here on out we can expect everything to erode, fairly swiftly. Illusions will be shattered, outrage will be shouted, and propaganda will run rampant. I wrote in 2017 that “scarcity will be the buzzword of the future” and that is about to be true in a way the vast majority would never have believed could happen to them. But despite causes, the unraveling has begun in earnest. And there’s no coming back. It’s hard to act as if things are normal or that they will surely return to normal, knowing all the while that they absolutely are not and will not. We’d better take a moment, soon, to take a deep breath and process it - and prepare in whatever ways we can. While the world spirals in a way none of us have ever before witnessed firsthand but some few of us foresaw coming, we must face a personal choice: we too can spiral into uncertainty, fear, obsession with blame, and propaganda - like the world at large seems to be doing - or we can tune out the irrelevant and focus on the things we can control and gain confidence, community, and peace of mind. CBS News: Russia says it's building a new "democratic world order" with China NY Times: What if Putin didn’t miscalculate? Lately, the population at large has been lulled back to sleep from these issues this summer because a lot of excess inventory is being sold, much of it at discount - gas prices have lowered, furniture and home goods are being discounted, and all the stuff you couldn’t find on Amazon or on store shelves seems to be back. This has caused a lot of people to sigh in relief, but it will be a false hope that will quickly turn to outrage. These trends may continue for a few months, but many warnings have popped up that should cause concern right before the midterm elections in the US in November. The stock market is expected to “price in” these expected shocks by October, and we are likely to see big price spikes and shortages again. Afterwards, this winter going into 2023, we will see incredible food shortages and subsequent violence around the world, along with a stock market meltdown worse than anything we’ve seen yet. The big dominoes will fall this winter. Don’t get lulled into complacency. This is the optimistic scenario, barring any “black swan” events to make it happen sooner (which seem more and more likely). The Coming Months: In preparing this Summer US Threat Assessment I believe any rational person must conclude that we should be Guarded - precautions are warranted, we need to monitor anticipated threats, and set up preparations. As we monitor conditions, I anticipate at some point over the next few months we will move quickly to an Elevated level - where an emergency is imminent, we must be prepared to act, and have all safeguards in place. Now is the time to prepare. We cannot dither or get distracted or complacent. Even if there are no “black swan events”, which is highly unlikely, there doesn’t seem much hope of going beyond early 2023 without proceeding to a High threat level - where an emergency has occurred that has significant impact to health/safety across the nation. Black Swan Event: A black swan is an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences. Black swan events are characterized by their extreme rarity, severe impact, and the widespread insistence they were obvious in hindsight.

0 Comments

Leave a Reply. |

The future is going to be far different than the past. The next decade is going to look vastly different than the last decade. This blog is about the transition.

If you like what you see, contribute to making this blog a success here:

Recent Posts: Physical Preps and Tools Prepping Priorities - Physical & Psychological 2022 US Threat Assessment Part II 2022 US Threat Assessment Part I GONE Bag: Get Out Now Emergency Tactical Gear Considerations Interview with Derrick Jensen 2020: A Marker For Collapse Firearms And Our Future Thermodynamic Failure: Phase 2 Firearms and Defense Syria 1971 Explaining Peak Oil Graduate-Level Preparedness The Significance of Renewables Preparing What Will The Future Look Like? What Do The Experts Say? Hope is Complex and Fragile Historical Perspective Personal Change Does Not Equal Social Change Why Genesis 1:28 Doesn't Apply It's Not About Running Out of Oil Introduction |

RSS Feed

RSS Feed